SPECIAL ISSUE PREVENTIVE RESTRUCTURING 9. Conclusion (1-8): Implementation of the Preventive Restructuring Directive 2019 in Review: a directive delivering on its promise?

This article sets out the background of the Preventive Restructuring Directive (2019/1023) (PRD 2019) and discusses the objectives set by the EU legislator. Moreover, this article contains a substantive comparison of seven domestic preventive restructuring frameworks, analysing the extent to which there is convergence among these frameworks, followed by an analysis showing that the Preventive Restructuring Directive has only partially delivered on its promises. These findings are important lessons as a next wave of harmonisation is forthcoming with the European Commission’s proposal for a directive harmonising certain aspects of insolvency law.

1. Introduction

Upon the adoption by the Council and the European Parliament of the Preventive Restructuring Directive (2019/1023) in June 2019,[1] it was up to the national legislators to ensure its timely transposition[2] into domestic restructuring and insolvency laws.[3] Besides provisions on a debt discharge to over-indebted entrepreneurs (Title III) and measures to improve efficiency of restructuring, insolvency and discharge procedures (Title IV), a key part of the PRD 2019 entails the so-called preventive restructuring frameworks (also PRFs) in Title II. This Title lays down a set of provisions that enable debtors that face financial distress to restructure by amending their capital structure, while continuing their business.

Although the PRD 2019 provides for minimum harmonisation, also for the PRFs, the EU legislator has not refrained from setting ambitious objectives. As part of its endeavour to build a European Capital Markets Union,[4] the PRD 2019 aims to contribute to reducing legal uncertainty and the costs of cross-border investments, but also to ‘enable debtors to restructure effectively at an early stage and to avoid insolvency, thus limiting the unnecessary liquidation of viable enterprises’.[5] Has the PRD 2019 succeeded in achieving such objectives? The expectations have been diverse: some expect that it may result only in a very limited degree of harmonisation,[6] others expect that reforms in national laws may benefit the economies of specific jurisdictions, in particular those lacking a preventive restructuring framework.[7] This paper reviews the objectives of the PRD 2019 and focuses on the question whether and to what extent the transpositions (already) deliver on the policy objectives. We do so by focusing at one part of the PRD 2019: the provisions on PRFs, as laid down in Title II PRD 2019. We adopt a ‘law at the books’ approach concerning the preventive restructuring frameworks in Austria, Denmark, France, Germany, Greece, the Netherlands and the United Kingdom, even though after Brexit the latter is no part of the EU anymore and, consequently, was not bound to implement the PRD 2019.[8]

The EU legislator has left considerable discretion to the Member States in transposing the PRD 2019. At first glance this seems commendable, as it allows national legislators to accommodate for the extensive difference between domestic laws. For instance, for some Member States, like France, it was commented that transposition would require limited reforms because already a more extensive domestic PRF was in place. However, for other Member States the PRD 2019 would require revision of existing restructuring regimes, or – as was the case with Denmark and the Netherlands – even introduction of new frameworks.[9] However, the degree of minimum harmonisation is also a direct impediment for any real harmonisation of PRFs. It leaves much discretion to Member States to design their own, diverse PRFs, limiting the de facto convergence.[10]

The rules on PRFs have brought about ample legal and academic debate.[11] In this regard, the PRD 2019 has been referred to positively as ‘a milestone in the harmonisation movement’,[12] but also more critically or negatively, as ‘a radical and substantive reform’,[13] or even ‘a refuge for failing firms’.[14] The PRD 2019 suggests that even in restructuring and insolvency law, as ‘one of the last vestiges of a nationalistic, codified approach to private law on the European continent’,[15] harmonisation is not a ‘mission impossible’. However, that depends not merely on the adoption of a directive, but even more so on its transposition. This study shows that to date, the results of the transpositions have only partially reached the PRD 2019’s objectives. This is important, as a next wave of harmonisation is forthcoming with the proposal for a directive harmonising certain aspects of insolvency law,[16] and lessons may be learned of what the PRD 2019 did and did not deliver to further effective efforts at harmonisation.

This paper is structured as follows: Section 2 sets out the background of the PRD 2019 and discusses the objectives set by the EU legislator. sequently, the paper contains a stantive comparison of seven domestic PRFs, analysing the extent to which there is convergence among these PRFs (Section 3), followed by an analysis showing that the PRD 2019 has only partially delivered on its promises (Section 4) and some final concluding remarks (Section 5).

2. Background PRD 2019

2.1. The EU’s efforts for a shared business rescue culture

Legislative efforts of some eight years culminated in the PRD 2019. The European Parliament can be seen as the instigator, with its Resolution in November 2011.[17] In this Resolution, the European Parliament called upon the Commission to bring forward legislative proposals that would also touch upon restructuring plans, as corporate rescue had emerged as an alternative to liquidation.[18]

Whereas the PRD 2019 is the first real binding legal instrument in the area of substantive European restructuring and insolvency law, it is the result of a long-running legislative process. By means of minimum harmonisation it introduces a framework – or toolbox – for Member States to introduce in its domestic legislation tools important to facilitate preventive restructuring. Therefore, the PRD 2019 functions as an important step for the EU to contribute to a paradigm shift at the European and domestic level promoting a shift away ‘[…] from the sacrosanct “pay what you owe” to the balanced promotion of the continuity of companies in distress […]’,[19] and therewith contributing towards a shared European rescue culture.[20]

2.2. Objectives of harmonised preventive restructuring frameworks

Before we can review whether the PRD 2019 is delivering on its promise, it should be made clear what the EU legislator – so to say – has ‘promised’. As has been reiterated many times, domestic insolvency regimes are widely differing,[21] this also regards restructuring frameworks. In 2014, the Commission published its Recommendation on a new approach to business failure and insolvency (Commission Recommendation 2014).[22] As noted in the Commission Recommendation 2014: ‘[n]ational insolvency rules vary greatly in respect of the range of the procedures available to debtors facing financial difficulties in order to restructure their business. Some Member States have a limited range of procedures meaning that businesses are only able to restructure at a relatively late stage, in the context of formal insolvency proceedings. In other Member States, restructuring is possible at an earlier stage but the procedures available are not as effective as they could be or involve varying degrees of formality, in particular in relation to the use of out-of-court processes.’[23] As an area that had benefited hardly from harmonisation before,[24] this is not surprising. At the same time, the Commission repeatedly pointed out that these differences cause problems to the internal market: ‘[t]he discrepancies between the national restructuring frameworks, and between the national rules giving honest entrepreneurs a second chance lead to increased costs and uncertainty in assessing the risks of investing in another Member State, fragment conditions for access to credit and result in different recovery rates for creditors. They make the design and adoption of consistent restructuring plans for cross-border groups of companies more difficult. More generally, the discrepancies may serve as disincentives for businesses wishing to establish themselves in different Member States.’[25]

Whereas the European Parliament recognised a need for harmonisation of restructuring and insolvency law in 2011, the Commission brought it within the scope of the Capital Markets Union. Here, the disparity of national restructuring and insolvency laws has been regarded as one of the key bottlenecks hampering cross-border investing in the European single market.[26] In this regard, insolvency laws play a key role in addressing financial distress. However, most domestic ‘frameworks seem unclear, inflexible and costly’, according to the European Parliament.[27] Therefore, harmonisation of restructuring law was aimed to contribute to creating more legal certainty for cross-border investors, but also to encourage that debtors will pursue restructuring timely.[28]

These two key objectives as stated in the Action Plan for the Capital Markets Union were reiterated in the legislative proposal in November 2016 for a directive on restructuring and insolvency (Proposal PRD 2016),[29] and elaborated in the accompanying Impact Assessment.[30] The Proposal PRD 2016 states that ‘[t]he aim is for all Member States to have in place key principles on effective preventive restructuring and second chance frameworks, and measures to make all types of insolvency procedures more efficient by reducing their length and associated costs and improving their quality. More specifically, such frameworks aim to help increase investment and job opportunities in the single market, reduce unnecessary liquidations of viable companies, avoid unnecessary job losses, prevent the build-up of non-performing loans facilitate cross-border restructurings, and reduce costs and increase opportunities for honest entrepreneurs to be given a fresh start.’[31] This is done because ‘a higher degree of harmonisation in insolvency law is thus essential for a well-functioning single market and for a true Capital Markets Union’.[32] However, from a more practical viewpoint, the Proposal PRD 2016 does not have the objective ‘to interfere with what works well, but to establish a common EU-wide framework to ensure effective restructuring, second chance and efficient procedures both at national and cross-border level.’[33]

The final text as adopted in the PRD 2019 finds its legal basis in Article 114 TFEU,[34] which regards private law harmonisation of direct and indirect obstacles to the internal market.[35] In this regard, recital 1 PRD 2019 lays down the main objective of the Directive: ‘[t]he objective of this Directive is to contribute to the proper functioning of the internal market and remove obstacles to the exercise of fundamental freedoms, such as the free movement of capital and freedom of establishment, which result from differences between national laws and procedures concerning preventive restructuring, insolvency, discharge of debt, and disqualifications.’

In order to reach this objective, the PRD 2019 provides for minimum harmonisation of preventive restructuring frameworks, in addition to separate rules on the debt-discharge for honest and insolvent or over-indebted entrepreneurs.[36] Especially with regard to preventive restructuring frameworks, it is stated that they should ‘enable debtors to restructure effectively at an early stage and to avoid insolvency, thus limiting the unnecessary liquidation of viable enterprises.’[37] In addition, the preventive restructuring frameworks should also serve other objectives, such as (i) preventing job losses, (ii) preventing the loss of know-how and skills, (iii) maximising the total value to creditors, but also to the owners and the economy as a whole, (iv) maintaining business activity, and (v) preventing the build-up of non-performing loans.[38]

In concluding, the above puts forward two overall key objectives of the PRD 2019 with respect to PRFs. First of all, that is to create more legal certainty for cross-border investment, by reducing the divergences between Member States. Second, it aims to enable debtors to restructure at an early stage, in order to avoid increasing losses and consequently, unnecessary insolvency proceedings. This brings us to discuss how the PRD 2019 has been transposed into national law, before evaluating to what extent the PRD 2019 has delivered on its promise.

3. Implementations of the PRD 2019: an overview

3.1. Introduction

To date, a majority of Member States have completed the implementation of the PRD 2019. In seven successive contributions in the HERO Special Issue I on preventive restructuring, the domestic preventive restructuring frameworks of Austria,[39] Denmark,[40] France,[41] Germany,[42] Greece,[43] the Netherlands[44] and the United Kingdom (UK) have been examined.[45] Apart from the former six, after Brexit, the UK was no longer under an obligation to implement the PRD 2019. However, their legislative reforms in this area closely resemble features of the preventive restructuring frameworks under the PRD 2019. Furthermore, the UK still has a prominent role in in the European restructuring and insolvency sector. Consequently, it has been included in this analysis of how the PRD 2019 has influenced domestic European restructuring laws.[46]

Per jurisdiction, the prior contributions analysed in detail the most important parts of the PRD 2019’s preventive restructuring frameworks. Here, we present a comparative study focussing on a selected number of these topics: the domestic approach to implementation (Section 3.2), the criteria or test to access preventive restructuring frameworks (Section 3.3), the actors involved in preventive restructuring frameworks (Section 3.4), the stay of individual enforcement actions (Section 3.5), the adoption and confirmation of restructuring plans (Section 3.6), and the jurisdiction for and recognition of court decisions relating to preventive restructuring frameworks (Section 3.7).

3.2. Domestic approach towards implementation

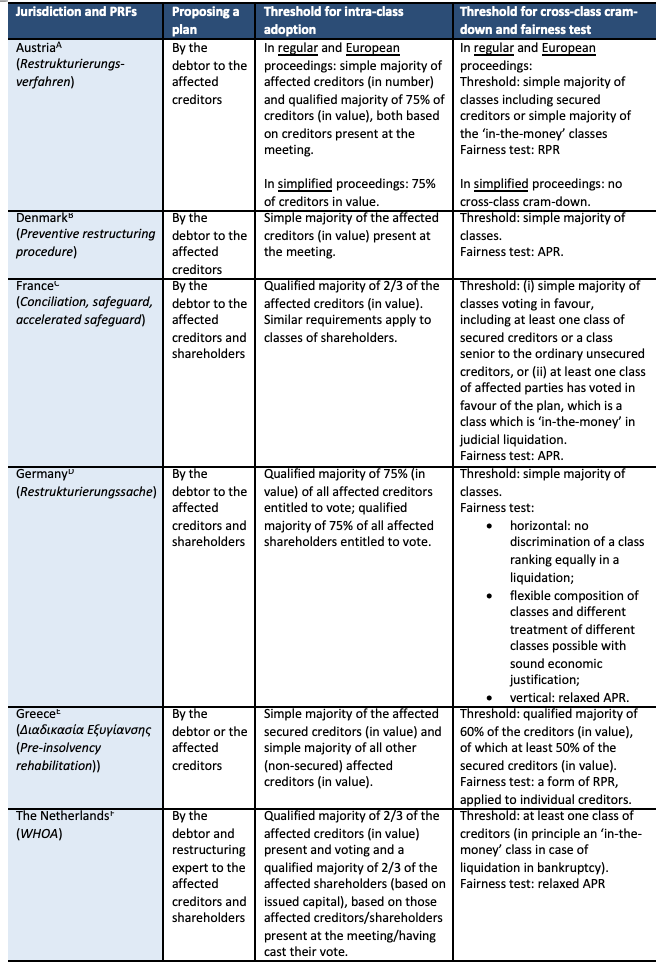

Jurisdictions are free to choose the form and method to implement directives.[47] Furthermore, the PRD 2019 also allows Member States to design preventive restructuring frameworks to consist of a single or multiple ‘procedures, measures or provisions’.[48] Adopting such measures may, but does not have to impinge on other solutions available in the domestic restructuring regimes to avoid insolvency.[49] This grants considerable discretion to national legislators in (re)shaping their preventive restructuring frameworks (Table 1).

The forms of implementing the PRD 2019 in the various Member States show some divergences. Except for France and Greece, all jurisdictions in this study introduced new preventive restructuring frameworks, adding it to their current restructuring and insolvency regime(s). In the Netherlands there was some discussion on possibly amending the existing suspension of payments, even while the Dutch WHOA was being drafted.[50] However, ultimately it was decided to consider the Dutch WHOA as the partial implementation of the PRD 2019.[51] For Greece, implementation of the PRD 2019 was part of a general overhaul of its insolvency laws,[52] whereas for the other jurisdictions the reform focused (primarily) on implementation of the PRD 2019 as such. The UK introduced a new preventive restructuring framework with two stand-alone measures, incorporated in the Companies Act 2006 and the Insolvency Act 1986. France too adopted features from the PRD 2019 in multiple processes, amending in particular the already existing safeguard and accelerated safeguard.

At the same time, most jurisdictions have maintained their existing restructuring and insolvency regime. This is explicitly permitted under the PRD 2019, stating that: ‘[t]his Directive should allow Member States flexibility to apply common principles while respecting national legal systems. Member States should be able to maintain or introduce in their national legal systems preventive restructuring frameworks other than those provided for by this Directive.’[53] In sum, the implementation of the PRD 2019 has mostly broadened the pre-existing regimes by extending the scope of restructuring tools available to debtors in financial distress.

3.3. Criteria and tests to access preventive restructuring frameworks

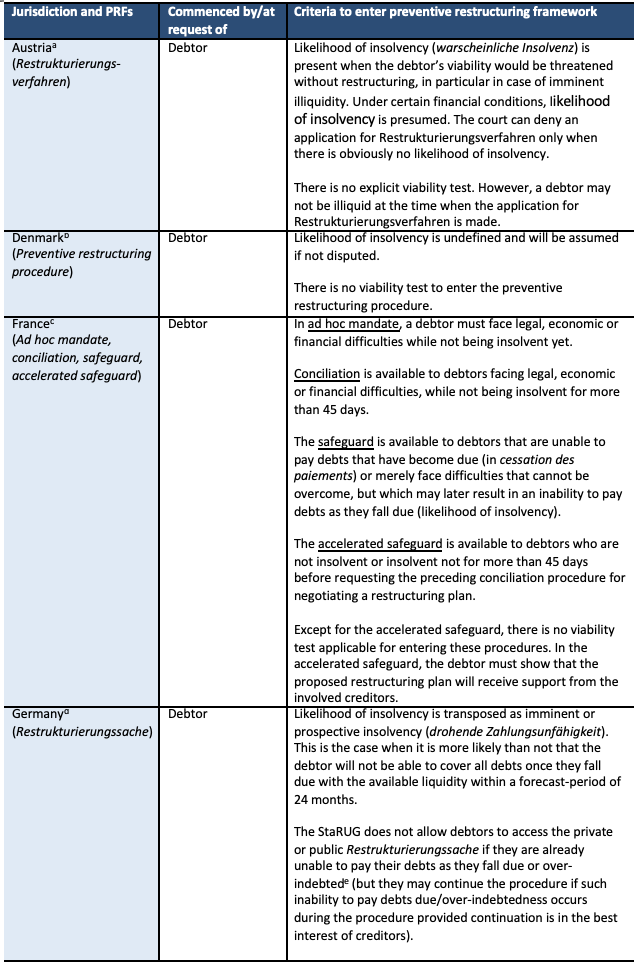

Under the PRD 2019, preventive restructuring frameworks should enable debtors ‘to restructure, with a view to preventing insolvency and ensuring their viability’.[54] To avoid the risk of preventive restructuring being misused to clear debts, ‘the financial difficulties of the debtor should indicate a likelihood of insolvency and the restructuring plan should be capable of preventing the insolvency of the debtor and ensuring the viability of the business.’[55] A preventive restructuring framework should furthermore be available to debtors at their request, but may also be available at the request of creditors and employees’ representatives.[56] This presented national legislators with various policy options in shaping the entry to the preventive restructuring frameworks (Table 2).

Lacking a definition of what ‘likelihood of insolvency’ entails in the PRD 2019,[70] the various jurisdictions have taken different approaches. Some have clearly described timeframes within which such a likelihood should be present (like Germany and France), others leave it more open for case-by-case assessment (the Netherlands), whereas again others do not give any indications (Denmark) or take a fluid approach by opening the frameworks not exclusively to debtors that are facing a likelihood of insolvency (Greece and the UK). Although the PRD 2019 gives much flexibility to the Member States to define likelihood of insolvency, it is unclear whether certain approaches fall within the envisaged scope of the PRD 2019, in particular when they include debtors that face formal insolvency. Then again, leaving the desirability of such varied approaches aside, the minimum harmonisation of the PRD 2019 does not explicitly preclude Member States from introducing a broader application of its preventive restructuring frameworks.[71]

To achieve more uniformity of the entry test, when debtors can access preventive restructuring frameworks, the EU legislator should take action. In the PRD 2019 it has intentionally been left to Member States themselves to define what ‘insolvency’ as well as ‘likelihood of insolvency’ are.[72] As the above shows, the results are divergent and possibly at odds with the objective of the PRD 2019 itself: creating more legal certainty for cross-border investment, by reducing the divergences between Member States and enabling debtors to restructure at an early stage, in order to avoid increasing losses and consequently, unnecessary insolvency proceedings.

In its recent Proposal to harmonise certain aspects of insolvency law, the European Commission provides further guidance on the intended scope of preventive restructuring frameworks under the PRD 2019. The Commission emphasises that the scope of preventive restructuring processes – as provided for by the PRD 2019 – is confined to ‘pre-insolvency’, this is to be distinguished from actual insolvency as well as post-insolvency.[73] However, once again driven by opposition of Member States, the Commission stays away from proposing any form of definition of these concepts in the Proposal itself.[74]

3.4. Actors involved in preventive restructuring frameworks

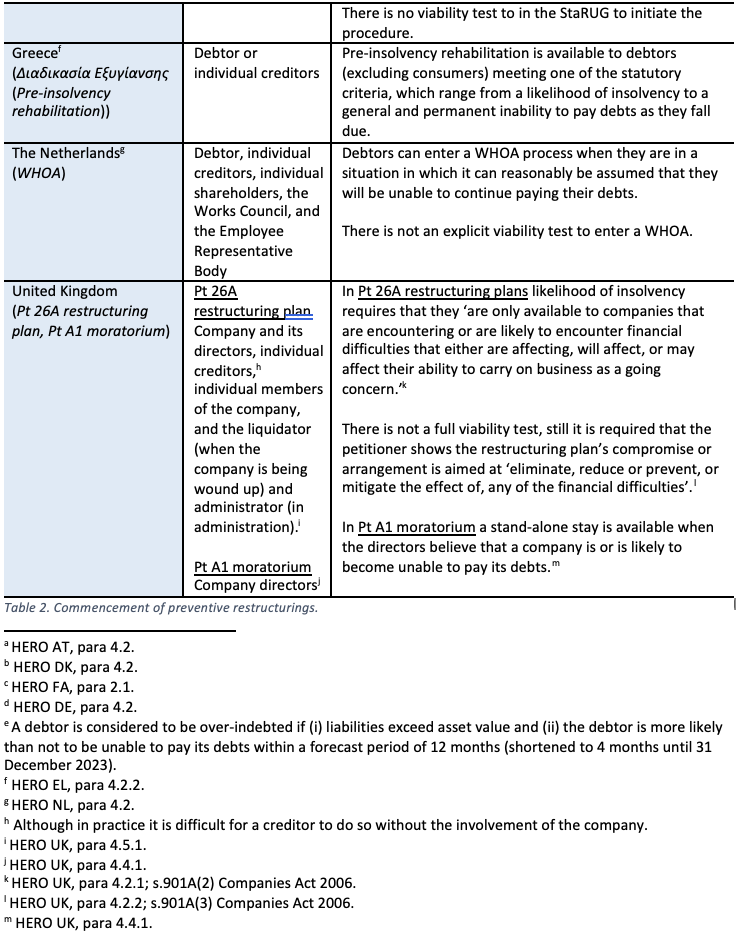

Article 5(1) PRD 2019 makes a clear choice regarding the governance of preventive restructuring frameworks with the debtor remaining fully or at least partially in possession over its assets and day-to-day operation of the business, the so-called ‘Debtor in Possession’ (DIP). The recitals reiterate that debtors should ‘in principle, be left in control of their assets and the day-to-day operation of their business.’[75]

The involvement of other actors and specialised practitioners – the so-called ‘Practitioner in the Field of Restructuring’ (PIFOR) – is optional on a case-by-case basis, subject to limited exceptions where mandatory appointment is warranted to protect the interests of the creditors.[76] This includes in particular the following situations: when its appointment is necessary to protect the creditors’ rights while a debtor benefits from a stay, in case of a confirmation of a restructuring plan which requires cross-class cram-down, and when a majority of the creditors request the appointment of a PIFOR.[77] Optional appointment of a PIFOR, on a case-by-case basis only, is possible when a restructuring plan affects the rights of workers or when a debtor’s management has acted criminally, fraudulently or otherwise detrimental in business relations.[78] Furthermore, Article 4(6) PRD 2019 provides that the involvement of a judicial or administrative authority may be limited to where it is necessary to protect the rights of affected parties and relevant stakeholders.

Compared to certain other parts of the PRD 2019, the EU legislator left limited room for divergence in transposing the Directive with respect to involvement of actors, which is also demonstrated in the implementations in the various jurisdictions (Table 3).

As Table 3 demonstrates, the various implementations show considerable convergence with respect to the PRD 2019’s ‘DIP Principle’, in which the debtor is left in full or at least partial control of its assets and affairs. For the Netherlands and the UK Pt A1 moratorium, a debtor stays fully in possession also when a PIFOR is appointed. However, most other jurisdictions in this study provide that a debtor may be divested in case a PIFOR is appointed. Such appointments entail in Austria, Denmark, France, and Germany only partial divestment of a debtor. Only in Greece the debtor may be fully divested in pre-insolvency rehabilitation, deviating from the DIP Principle.

In most jurisdictions the involvement of a PIFOR is decided on a case-by-case basis, which is the case in Austria, Denmark, Germany, Greece, and the Netherlands. Deviating from the PRD 2019, others provide for mandatory appointment of PIFORs. For instance in France, if certain conditions are met, PIFORs are appointed mandatorily (ad hoc mandate, conciliation, safeguard and accelerated safeguard). Even though these French PIFORs do not always divest the debtor, it is not consistent with the PRD 2019. In the UK Pt A1 moratorium, a PIFOR is appointed mandatorily, however, this falls within the exception of Article 5(3)(a) PRD 2019.

According to the exception of Article 5(3) PRD 2019, the appointment of a PIFOR is envisaged typically (if necessary) when a stay is granted, when confirmation involves a cross-class cram-down or when (a majority of) the creditors request its appointment. Germany and the Netherlands follow these minimum grounds strictly. On the other end of the spectrum, Austria and Greece take a much more ‘generous’ approach for appointing a PIFOR, while in France it is mandatorily in every case. This is opposed to the Danish approach, where mandatory appointment of a PIFOR is available only in case of a stay. A notable exception is the UK, where Pt 26A restructuring plan does not envisage the appointment of a PIFOR at all, similar to the UK Scheme of Arrangement. In sum, most jurisdictions in this study require appointment of a PIFOR, at least in the categories listed in Article 5(3) PRD 2019. However, there are still some considerable divergences, even deviating from the PRD 2019. It is also problematic that the role of the PIFOR seems to lack clear articulation in some jurisdictions. In Greece, the relevant provision merely states that a PIFOR may be assigned the partial or full administration over the debtor’s estate. This is different in the Netherlands and Germany which have introduced different types of PIFORs, with more elaborate provisions on their respective rights and duties.

For all jurisdictions, the involvement of the court or an administrative authority in the governance of the restructuring process is generally limited. Court involvement relates mostly to responding to requests from the debtor (such as granting a stay or confirming a plan), and sometimes also from other (affected) parties (for example to appoint a PIFOR). This is less so in court-supervised processes in France, such as the (accelerated) safeguard, where each case involves a supervisory judge.[88]

3.5. Stay of individual enforcement actions

The PRD 2019 requires availability of a stay ‘to support the negotiations of a restructuring plan’.[89] It provides, however, extensive policy options to national legislators in shaping the stay, including the scope of a stay (who is affected), the effects of stay (what does it entail), duration of stay (how long), and how a stay can be lifted (under which conditions).[90] Under the PRD 2019, a stay should be available at the request of debtors, for an initial duration of not more than four months and in total not more than twelve months. This has been implemented in various ways (Table 4).[91]

It follows from Table 4 that each jurisdiction in this study offers a stay, mostly within a PRF. The UK stands out as it has a standalone stay, separate from its preventive restructuring frameworks. A stay is typically available at the request of a debtor, although in the Netherlands also at request of a PIFOR.

In line with the PRD 2019, the initial duration is not more than four months (although varying between 20 business days to four months). The total duration is capped at 12 months in Denmark, France (safeguard), Greece (stay upon request for confirmation), and the UK. However, several jurisdictions have opted to limit the maximum duration to eight (Germany and the Netherlands), six (Austria) or even just four months (France, in the accelerated safeguard). Looking at these minimum standards for stays and noting still considerable differences in the duration of stays, most jurisdictions offer at least one stay in line with the PRD 2019.

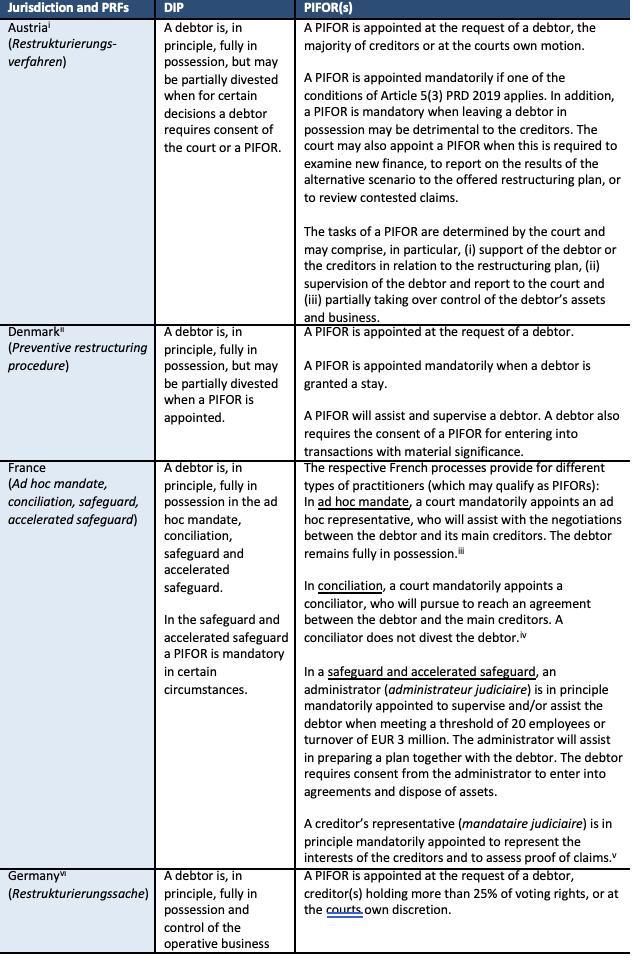

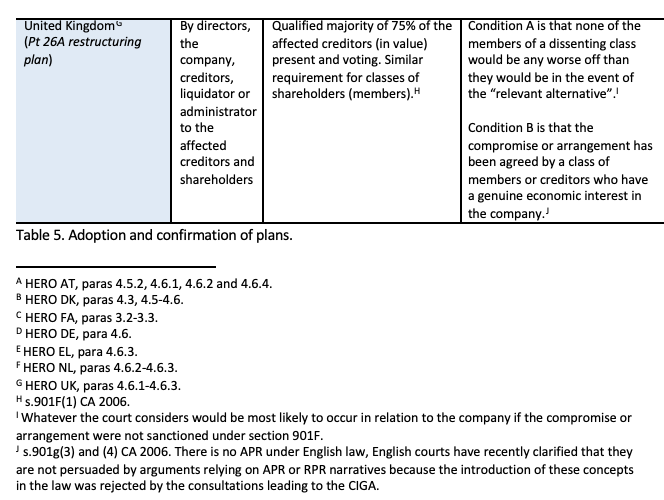

3.6. Adoption and confirmation of restructuring plans

Chapter 3 of the PRD 2019 regulates the restructuring plan, including the contents of a plan, class formation, as well as the voting, the adoption, and the confirmation of plans, including grounds for rejecting confirmation. There is a plethora of options for legislators. For instance, whether class formation is mandatory for SME debtors, whether shareholders’ and workers’ rights can be affected, and how reorganisation value should be distributed under the plan.[99] As the IMF pointed out, the intricacy for the EU legislator was balancing a framework that maximises legal flexibility without necessitating full legal scrutiny by a court.[100] Whereas the PRD 2019 lays down many minimum standards and policy options, in this section we focus our analysis to four features of restructuring frameworks: (i) who can propose a plan and who can be affected by the plan, (ii) what is the threshold for intra-class adoption of a plan, (iii) what is the threshold for a plan to be eligible for cross-class cram-down, and (iv) what fairness test applies in a cross-class cram-down.

As a minimum, the PRD 2019 requires that a debtor is able to propose a plan, but also creditors and/or PIFORs may be granted the right to submit competing plans.[101] The PRD 2019 gives national legislators considerable discretion in considering who will be affected by the plan. However, all affected parties must have the right to vote on the plan.[102] A class of such affected creditors and/or shareholders will have adopted a plan if there is majority in value of claims or interests. National legislators may not require a majority exceeding 75%.[103] If all classes adopt the plan with the required majority, the plan may – subject to other criteria including the best-interest-of-creditors test – be confirmed.[104]

When a plan has not been adopted by all classes, it may still be confirmed by the court by means of a cross-class cram-down. A plan will be eligible for confirmation subject to several requirements. A plan must have been adopted (i) by a majority of all voting classes (including one secured class or class senior to the unsecured creditors class), or (ii) at least one class of creditors that would be ‘in-the-money’ in case of either a going-concern sale or in a liquidation proceeding.[105]

Besides the best-interest-of-creditors test, in this case also the fairness test must be adhered too for dissenting classes. The EU legislator has introduced – which resulted in a vivid academic debate[106] – that this could be based on the so-called relative priority rule (RPR), the absolute priority rule (APR), or a relaxed version of the APR. The RPR entails that in distributing the reorganisation value (the excess value compared to the next best alternative to the restructuring) any dissenting class of creditors should be treated at least as favourable as classes of an equal rank and more favourable than any junior class.[107] This is much more flexible than the APR, under which a lower ranking class can receive value only when any higher ranking class is paid in full.[108] Whereas the latter can be rather strict, implementations may also provide for a ‘relaxed APR’ or ‘relaxed RPR’, where limited deviations from the APR or RPR are acceptable when they are necessary to achieve the aims of an restructuring.[109]

All jurisdictions in this study allow a debtor to propose a plan, but in Greece, the Netherlands and the UK it has been extended to certain other parties, such as creditors and/or practitioners. Noticeable is the Greek option in the pre-insolvency rehabilitation where creditors may pursue a restructuring without any direct involvement of a debtor.[120]

The threshold for intra-class adoption of restructuring plans shows much diversity, and it is doubtful whether the PRD 2019 succeeded in any actual harmonisation. The required majority differs between a simple majority, or a qualified majority of 2/3 or 75% of the value of the claims of creditors and/or interests of shareholders. However, Austria also requires a majority in number of affected parties that voted. Furthermore, Germany requires the majority to be calculated based on all affected parties in a class, whereas most other jurisdictions allow for the majority to be calculated based on the affected parties present and voting. With regard to the threshold for requesting a cross-class cram-down, there is also some divergence, but several jurisdictions remain close to the requirements as listed in Article 11(1)(b) PRD 2019.

In addition, the applied fairness tests show great diversity among jurisdictions. Denmark and France strictly apply the APR, Germany and the Netherlands have opted for the relaxed APR. Austria and Greece have opted for the RPR, and the UK has not adopted a statutory fairness test. It is without saying that the features reviewed here with respect to adoption and confirmation of restructuring plans show it is hard to detect any clear convergence in Europe as regards adoption and confirmation of plans in preventive restructuring frameworks. Much will depend on how the courts will apply these tests in practice.

3.7. Jurisdiction for and recognition of court decisions in Europe

Whereas the PRD 2019 is introduced to reduce the costs for cross-border investors, the EU legislator has given limited consideration of the cross-border aspects of preventive restructuring frameworks. It must be noted that the EIR 2015 covers preventive restructuring frameworks that meet its requirements, including that it is a ‘public’ collective proceeding.[121] The PRD 2019 is without prejudice to the EIR 2015, thus enabling that within the EU (excluding Denmark), preventive restructuring frameworks listed on Annex A of the EIR 2015 would benefit from its framework for jurisdiction, recognition, and enforcement of judicial decisions as well as its mechanism protecting against abusive relocation of the centre of main interests of debtors.[122]

A notable feature, which has arisen also in implementations of the PRD 2019, is that preventive restructuring frameworks do not necessarily meet the requirements of an ‘insolvency proceeding’ under the EIR 2015. This relates in particular to the requirement of publicity for insolvency proceedings falling within the scope of the EIR 2015.[123] The EU legislator has remained silent on questions of jurisdiction and recognition in this regard, which has resulted in considerable uncertainty across Europe.[124] Therefore, it remains unclear whether questions of jurisdiction, recognition and enforcement of decisions in such PRFs are subject to the Brussels Ibis Regulation (Brussels Ibis)[125] or fall within the scope of domestic private international rules. As a result, diverse and sometimes hesitant approaches have been taken on this matter, as is reflected in Table 6 dealing with the question of jurisdiction for (rendering decisions in) PRFs.

It is clear that – except for Denmark and the UK to which the EIR 2015 does not apply – various preventive restructuring frameworks have been listed as ‘insolvency proceeding’ on Annex A of the EIR 2015. Whereas the EIR 2015 provides a well-functioning framework for cross-border effect of insolvency proceedings, it is criticised as incompatible with preventive restructuring.[134] When it comes to jurisdiction and recognition for those preventive frameworks that are not on Annex A or when it regards third countries (and the EIR 2015 does not apply), it is clear that not only the EU legislator, but also national legislators have left considerable uncertainty to the market. The Dutch legislator has made a clear choice, but most jurisdictions have remained silent. If the EU legislator will not address this itself, which for now seems to be the case, it appears to be left ultimately to the CJEU to resolve.

In the recitals to the PRD 2019, it is rightly emphasised that the EIR 2015 was not able to resolve disparities between domestic preventive restructuring frameworks. In addition, it is stated that ‘an instrument limited only to cross-border insolvencies would not remove all obstacles to free movement, nor would it be feasible for investors to determine in advance the cross-border or domestic nature of the potential financial difficulties of the debtor in the future’.[135] Our analysis suggests that the opposite may also be true. By ignoring the implications of preventive restructuring in a European market and leaving untouched the need for an adequate cross-border insolvency regime, the PRD 2019 leaves ample uncertainty for jurisdiction, recognition and enforcement of decisions during a PRF. As a result, the EU legislator may effectively have created an impediment to the free movement of capital, contrary to the objectives of the PRD 2019.

4. Does the PRD 2019 deliver on its promise?

4.1. Introduction

The discussion in Section 3 shows that the implementations of the PRD 2019 in the various jurisdictions in this study bring about a rather divergent picture. It is clear that in considering the policy alternatives of the PRD 2019, national legislators have taken different choices. The variety in outcomes is a serious impediment in formulating an answer to the question whether the approach adopted by the EU legislator – minimum harmonisation of preventive restructuring by means of a directive – has been successful in achieving the aforementioned key objectives of reducing legal uncertainty for cross-border investment and promoting early restructuring of financially distressed debtors. Or to put it differently, whether the introduction of or amendments to domestic preventive restructuring frameworks have been effective. There are several considerations to take into account.

First, what can we justifiably assess at this moment, with for some jurisdictions some two years, but for most jurisdictions less of experience with a new or amended legal framework? An analysis of the effectiveness will therefore be done based predominantly on a so-called ‘law at the books’ approach. Although a further analysis of the ‘law in action’ will certainly provide more insights, that remains difficult to achieve shortly after the implementation.

Second, the high degree of minimum harmonisation – including the possibility to introduce preventive restructuring tools in multiple procedures, measures or provisions – complicates any assessment of effectiveness. Although there is an obligation that restructuring frameworks must provide a coherent protection of the rights of the affected parties, such as debtors, creditors, shareholders, workers etc,[136] this in itself is insufficient to guarantee effectiveness of the frameworks. However, it requires as a first step an understanding of how the implementation has been used to shape preventive restructuring frameworks in the respective jurisdictions.

Third, one might be critical about the PRD 2019’s assumptions, including the presumed economic effects of the availability of preventive restructuring frameworks.[137] This draws indeed to limitations of the PRD 2019 as a tool to reach certain policy objectives. For instance, (i) preventive restructuring frameworks are merely one indicator among many that are relevant for the (costs of a) cross-border investment climate in Europe, and (ii) the minimum standards laid down in the PRD 2019 provide mostly for a formal legal framework for preventive restructuring. One must be aware that the impact of PRFs on cross-border investment has not been substantively quantified.[138] Similarly, the effectiveness of the preventive restructuring tools will also depend on their implementation and application in domestic law, the coherence between the different tools, as well as the domestic legal culture including the expertise and experience of judges and practitioners.[139] In short, effectiveness may be a very different concept in practice than it is in the law.[140]

The next two sections contain a discussion about the extent to which the PRD 2019 has (already) achieved its objectives. First, we investigate whether and to what extent the PRD 2019 has reduced legal uncertainty on preventive restructuring frameworks (Section 4.2). Second, we review the extent to which the PRD 2019 has succeeded in promoting early restructuring by debtors (Section 4.3).

4.2. PRD 2019 as a means to reduce legal uncertainty over preventive restructuring

Section 3 dealt with the approaches that several national legislators took in implementing the PRD 2019. Except for France and Greece, the other jurisdictions introduced new preventive restructuring frameworks as an addition to the pre-existing domestic restructuring and insolvency regime. However, compared to the poor follow-up to the Commission Recommendation 2014 by the Member States, the PRD 2019 can be considered all-in-all to have succeeded in bringing top-down harmonisation amending the ‘law at the books’.

Furthermore, there are also some traces of regulatory competition between European legislators. We draw on two examples: first, although no longer a Member State, also the UK has introduced in recent years its new restructuring plan and standalone moratorium. Although this legislative initiative commenced before the PRD 2019 was adopted, as pointed out by Vaccari and Gant, the reform shows resemblance to the PRD 2019.[141] It illustrates that the PRD 2019 had a prospective and broader standard-setting influence. In addition, some jurisdictions introduced features to their new preventive restructuring frameworks, which were not explicitly provided for by the PRD 2019. This is the case in particular with the dual track preventive restructuring. Under this approach, proposed first in the Netherlands, preventive restructuring framework is available both as a private (not listed on Annex A the EIR 2015) and public process (listed on Annex A to the EIR 2015), has been taken on board also in Germany and Austria. This marks that legislators have considered each other’s implementation on these and possibly other features too.

Does this also lead to the conclusion that the PRD 2019 has succeeded broadly in harmonising preventive restructuring frameworks? Based on our study, for now, we come to answer that question in the negative. Reviewing the implementation of the PRD 2019 in six Member States clearly shows that national legislators took ample use of the flexibility offered by the PRD 2019,[142] and sometimes even seem to have gone beyond.[143] The divergences are reflected both in forms in which the provisions on preventive restructuring have been implemented, introducing one or multiple new ‘procedures, measures or provisions’,[144] as well as in taking different choices on the policy options provided by specific provisions of the PRD 2019. This results not only in quite disparate legal regimes, but possibly also in dynamics within processes themselves. For one, most poignantly, this relates to the effective usability of the preventive frameworks, which for certain jurisdictions has already received severe critiques. The Commission has deliberately chosen for this minimum harmonisation, as this would not ‘interfere with what works well’.[145] That fits our perception, where the national legislators designed preventive restructuring frameworks typically in addition to the existing framework, while making use of the many policy options the PRD 2019 offers. At the same time, this does not match with the Commission’s objective to ‘ensure major progress towards the functioning of the internal market.’[146] As a consequence, we must be cautious to conclude whether the EU legislator’s aim to reduce barriers to cross-border investments by minimising legal uncertainty on preventive restructuring, has been achieved. Further research, especially on the ‘law in action’, will be necessary to determine how cross-border investors assess the investment risks with preventive restructuring frameworks across Europe.

Ehmke et al. predicted already that the amount of actual harmonisation among Member States might be limited as the PRD 2019’s toolbox allowed for (too) many options.[147] In a comparison of implementations of the PRD 2019 and commentaries on Austria, Germany, Italy, Spain, and the UK, Thole observes a considerable convergence among jurisdictions, despite noticing various differences.[148] Bork and Mangano on the other hand express concerns for these differences, noting that this in fact leads to ‘disharmonising’ restructuring law. It must be noted that they do so in particular from a cross-border insolvency perspective, noting that for different reasons several new PRFs are not included on Annex A of the EIR 2015.[149] However, in a study by Gant et al., it is reiterated that the national transposition efforts take different speeds, also depending on varying domestic circumstances. Therefore, it may take some time before we can draw conclusions.[150]

Nonetheless, we also note that some steps in the direction of further harmonisation have been made. First, the PRD 2019 introduced a shared European terminology of preventive restructuring vocabulary. It also created common ground for various concepts which have become part now in domestic regimes. Second, it was aimed that the PRD 2019 would bring convergence, such that ‘cross-border investment would no longer be inhibited by concerns that, for example, preventive restructuring of the debtor is not effectively possible in all Member States’.[151] The PRD 2019 has indeed contributed to such convergence by introducing a more shared framework for preventive restructuring among Member States. Although, as previously discussed, the significant and substantive differences between jurisdictions downplay the level of harmonisation, it nevertheless resulted in a more shared, common ground for preventive restructuring. Third, the PRD 2019 has shown that substantive harmonisation in restructuring and insolvency law is not impossible, an assumption that – based on the very diverse domestic regimes – over a long time played a dominant role in inhibiting efforts to bring convergence in this area.

4.3. PRD 2019 as a means to promote early restructuring by debtors

The PRD 2019 requires that all Member States will have a preventive restructuring framework in place. To date, most Member States have done so already. Although the implementation deadline – including extension – has passed, in some Member States full implementation and notification of the implementation measures to the Commission is still pending.[152] Upon completion, de jure, this will promote the availability of early restructuring for debtors in all Member States, as aimed for by the EU legislator. However, it remains to be seen if this will also practically result in more early restructuring. As the Greek contributors stated: ‘It still remains to be seen whether the new framework will prove up to the task of addressing the issues faced by debtors and creditors and the economy at large.’[153] A difficulty is the limited uptake of preventive restructuring frameworks in several Member States. Different from the Netherlands,[154] there have been no cases reported in Austria.[155] In Germany and the UK, the number of cases is lower than expected.[156] In the UK, they expected between 50-100 cases, with only 9 in the first year.[157] Although this may give an indication of the de facto success of the PRD 2019, its limited use may be impacted by various factors. This has no doubt been influenced by the overall decline in the number of insolvency proceedings since the COVID-19 pandemic due to massive government liquidity support schemes,[158] which were already rather low in years before. Furthermore, it is not clear to what extent preventive restructuring frameworks have rather promoted informal, consensual restructurings, and where PRF are effectively a ‘stick’ for when these approaches do not succeed.

The authors of the seven national contributions have pointed already at several areas to improve the domestic preventive restructuring regimes. There have been some suggestions regarding aspects that go beyond the scope of Title II of PRD 2019. This relates to jurisdiction, recognition and enforcement of (decisions taken in) preventive restructuring frameworks (Section 3.7 above),[159] but also the training and expertise of practitioners and judges.[160] However, there are more critical observations by several authors. Some have stated that their domestic preventive restructuring framework could benefit from further legal clarity.[161] Some have pointed at specific features, including the entry test to commence a preventive restructuring framework, treatment of executory contracts, availability of a debt-for-equity swap,[162] Others more generally stated that ‘there is certainly need to still improve the [Austrian PRF] in several aspects.’[163] These issues may result, in particular, in time and cost inefficiencies for the involved parties, which may cause barriers especially for micro, small and medium sized debtors to enter such frameworks.[164] Or even more drastically, some concerns were raised on the actual usefulness of the new preventive restructuring framework.[165] Although further research is necessary, it suggests that mere implementation itself may not be sufficient to achieve the EU legislator’s aim to promote early restructuring of debtors.

5. Concluding remarks

The PRD 2019 has not become, what some expected it to be, a ‘[p]rocrustean bed that rules out radical innovations with respect to corporate restructuring regimes’.[166] Neither can it be considered the panacea for a European business rescue culture. The minimum harmonisation of the PRD 2019 has resulted in – quite literally – minimum harmonisation in Europe. In transposing the PRD 2019, a plethora of divergences have emerged, however, mostly within the PRD 2019’s policy options. Taking a ‘law at the books’ approach in reviewing recent reforms in Austria, Denmark, France, Germany, Greece, the Netherlands, and the United Kingdom shows that ‘what you see is what you get’.

The approach of minimum harmonisation has delivered on ‘its’ promise, but that does not match the overall objectives of the PRD 2019. The conclusion of this study, reviewing whether the EU legislator has succeeded in fully achieving objectives, must be answered in the negative. At this point, it is at least doubtful whether the EU legislator’s objective to reduce legal uncertainties in (preventive) restructuring for cross-border investments has succeeded. Although a baseline for preventive restructuring has been established, the ‘law at the books’ show extensive differences. We observe that much uncertainty between jurisdictions remains, where key concepts have not been harmonised since uniform definitions lack and due to the many policy options national legislators can choose from. This has hampered the objective to effectively address legal uncertainty for cross-border investors.

Nevertheless, we can be more optimistic about the objective to promote restructuring at an early stage and avoid unnecessary liquidation. Nearly all Member States have – some still have to implement the PRD 2019 – a preventive restructuring framework in place, which works along certain minimum standards. This will contribute to restructuring at an early stage. However, the actual success of the PRD 2019 is to be reviewed by looking also at the ‘law in action’: are the preventive restructuring frameworks effective and efficient? Are the courts, DIPs and PIFORs able to deliver on the promises of the frameworks? To what extent do preventive restructuring frameworks promote restructuring in the shadow of the law?

Whereas several jurisdictions report that their new preventive restructuring framework has been used only limitedly to date, it is interesting to observe what uptake they will get in the aftermath of the COVID-19 pandemic and also to what extent this may drive harmonisation through regulatory competition. However, this may be impeded because of the lack of cross-border effects of decisions in preventive restructuring cases. At this stage, there is too little data – including actual cases – to say that the PRD 2019 has succeeded in achieving its objectives.[167] Our analysis shows that also in practice this may be a ‘tough nut to crack’.

In addition to critically assessing the harmonisation brought about for preventive restructuring, we also observe that the PRD 2019 has opened Europe’s view on harmonisation in restructuring and insolvency. No longer is this an area where substantive harmonisation is unattainable, merely because of the large divergences. In that observation lies a promise for future initiatives. As we are at the start of a next wave of harmonisation of EU insolvency with the recent EU Proposal for a directive to harmonise certain aspects of insolvency law,[168] this paradigm shift that results from the PRD 2019 may prove to be of more significance and relevance than the current state of harmonisation of preventive restructuring laws does credit to the PRD 2019.

* We thank the authors of the contributions of the HERO special issue I on preventive restructuring, as well as Pien Kets (lecturer at Leiden University) for her assistance with the research for this paper. All sources have been checked on 1 August 2023.

[1] Directive (EU) 2019/1023 of the European Parliament and of the Council of 20 June 2019 on preventive restructuring frameworks, on discharge of debt and disqualifications, and on measures to increase the efficiency of procedures concerning restructuring, insolvency and discharge of debt, and amending Directive (EU) 2017/1132 (Directive on restructuring and insolvency), O.J. L 172/18.

[2] In this contribution, transposition is used synonymously to implementation, and vice versa.

[3] Articles 34 and 35 PRD 2019.

[4] Recital 8 PRD 2019.

[5] See for instance recitals 2, 7 and 9 PRD 2019.

[6] D.C. Ehmke, J.L.L. Gant, J.M.G.J. Boon, L. Langkjaer & E. Ghio, ‘The European Union preventive restructuring framework: A hole in one?’, International Insolvency Review, 2019, 28(2), para 5.

[7] European Bank for Reconstruction and Development, EBRD Insolvency Assessment on Reorganisation Procedures, 2022, p. 4, 10; R.P. Freitag, ‘General Aspects of the Directive on Restructuring and Insolvency’, Zeitschrift für Vergleichende Rechtswissenschaft, 2022, 121, p. 243-244.

[8] This paper provides a synthesis and analysis of contributions that have been published in the HERO special issue I on preventive restructuring. These contributions are available at: www.online-hero.nl.

[9] D.C. Ehmke, J.L.L. Gant, J.M.G.J. Boon, L. Langkjaer & E. Ghio, ‘The European Union preventive restructuring framework: A hole in one?’, International Insolvency Review, 2019, 28(2), para 4.1 and 5.

[10] D.C. Ehmke, J.L.L. Gant, J.M.G.J. Boon, L. Langkjaer & E. Ghio, ‘The European Union preventive restructuring framework: A hole in one?’, International Insolvency Review, 2019, 28(2), para 5.

[11] Consider for instance: H. Eidenmüller, ‘Contracting for a European insolvency regime’, European Business Organization Law Review, 2017/18, p. 273-304; R.J. de Weijs, A. Jonkers & M. Malakotipour, ‘The Imminent Distortion of European Insolvency Law: How the European Union Erodes the Basic Fabric of Private Law by Allowing 'Relative Priority' (RPR)’, Tijdschrift voor Belgisch Handelsrecht, 2019/125(4), p. 477-493; D.C. Ehmke, J.L.L. Gant, J.M.G.J. Boon, L. Langkjaer & E. Ghio, ‘The European Union Preventive Restructuring Framework: a Hole in One?’, International Insolvency Review, 2019(28), p. 208-209.

[12] M. Vanmeenen, ‘Pre-Insolvency Arrangements: The Belgian Experience’, in: R. Parry and P.J. Omar (eds.), Reimaging Rescue, Nottingham: INSOL Europe 2016, p. 162.

[13] D.C. Ehmke, J.L.L. Gant, J.M.G.J. Boon, L. Langkjaer & E. Ghio, ‘The European Union preventive restructuring framework: A hole in one?’, International Insolvency Review, 2019, 28(2), para 1.

[14] H. Eidenmüller, ‘The Rise and Fall of Regulatory Competition in Corporate Insolvency Law in the European Union’, European Business Organization Law Review, 2019/20, p. 559.

[15] J.H. Dalhuisen, ‘Harmonization of substantive Insolvency Law in the EU’, Maandblad voor Vermogensrecht, 2021/5, p. 159, who uses this quote to refer to the more recent publication by the European Commission, Proposal for a Directive of the European Parliament and the Council harmonising certain aspects of insolvency law, 7 December 2022, COM(2022) 702 final.

[16] European Commission, Proposal for a Directive of the European Parliament and of the Council harmonising certain aspects of insolvency law, 7 December 2022, COM(2022) 702 final.

[17] European Parliament resolution of 15 November 2011 with recommendations to the Commission on insolvency proceedings in the context of EU company law (2011/2006(INI)). The Resolution built on two studies that were commissioned by the European Parliament: European Parliament, ‘Harmonisation of insolvency law at EU level, note’, European Parliament 2010, PE419.633, and European Parliament, ‘Harmonisation of insolvency law at EU level with respect to opening of proceedings, claims filing and verification and reorganisation plans, note’, 2011, PE 432.766.

[18] European Parliament resolution of 15 November 2011 with recommendations to the Commission on insolvency proceedings in the context of EU company law (2011/2006(INI)), recitals I, J and L, and Annex at 1.1 and 1.5.

[19] B. Wessels, ‘On the future of European Insolvency Law’, in: Rebecca Parry (ed.), European Insolvency Law: Prospects for Reform, Nottingham: INSOL Europe 2014, p. 157.

[20] See for instance: J.M.G.J. Boon and S. Madaus, ‘Toward a European Business Rescue Culture’, in: J.A.A Adriaanse & J.I, van der Rest (eds.), Turnaround Management and Bankruptcy: A Research Companion (Routledge Advances in Management and Business Studies), New York: Routledge 2017; B. Wessels and S. Madaus, Instrument of the European Law Institute on Rescue of Business in Insolvency Law, 2017, p. 6; E. Ghio, J.M.G.J. Boon, D.C. Ehmke, J.L. Gant, L. Langkjaer & E. Vaccari, ‘Harmonising Insolvency Law in the EU: New Thoughts on Old Ideas in the Wake of the COVID-19 Pandemic’, International Insolvency Review,2021, 30(3), p. 434-435.

[21] See for instance: Recital 11 Council Regulation (EC) No 1346/2000 of 29 May 2000 on insolvency proceedings, O.J. L 160; Recital 22 Regulation (EU) 2015/848 of the European Parliament and of the Council of 20 May 2015 on insolvency proceedings (recast), O.J.L 141/19; European Parliament resolution of 15 November 2011 with recommendations to the Commission on insolvency proceedings in the context of EU company law (2011/2006(INI)), recitals A; Communication from the Commission to the European Parliament, the Council and the European Economic and Social Committee, A new European approach to business failure and insolvency, 12 December 2012, COM(2012) 742 final, para 5; Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Action Plan on Building a Capital Markets Union, 30 September 2015, COM(2015) 468 final, para 6.1; European Commission, Commission staff working document, Economic analysis, Accompanying the document Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Action Plan on Building a Capital Markets Union, 30 September 2015, SWD(2015) 183 final, p. 73-74; Proposal PRD 2016, p. 2; Recital 4 PRD 2019.

[22] Commission Recommendation on a new approach to business failure and insolvency, 12 March 2014, C(2014) 1500 final.

[23] Recital 2 Commission Recommendation 2014.

[24] See also B. Wessels, ‘On the Future of European Insolvency Law’ in Rebecca Parry (ed.), European Insolvency Law: Prospects for Reform, Nottingham: INSOL Europe 2014, p. 131-158; J.M.G.J Boon, Harmonising European Insolvency Law: The Emerging Role of Stakeholders, International insolvency Review, 2018, 27(2), p. 162-163.

[25] Recital 4 Commission Recommendation 2014.

[26] Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Action Plan on Building a Capital Markets Union, 30 September 2015, COM(2015) 468 final, para 6; European Commission, Commission staff working document, Economic analysis, Accompanying the document Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Action Plan on Building a Capital Markets Union, 30 September 2015, SWD(2015) 183 final, p. 74-77.

[27] European Commission, Commission staff working document, Economic analysis, Accompanying the document Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Action Plan on Building a Capital Markets Union, 30 September 2015, SWD(2015) 183 final, p. 73.

[28] Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Action Plan on Building a Capital Markets Union, 30 September 2015, COM(2015) 468 final, para 6.

[29] Proposal for a Directive of the European Union and the Council on preventive restructuring frameworks, second chance and measures to increase the efficiency of restructuring, insolvency and discharge procedures and amending Directive 2012/30/EU of 22 November 2016, COM(2016) 723 final (Proposal PRD 2016).

[30] Proposal PRD 2016, p. 2; Impact Assessment Proposal PRD 2016, p. 13 et seq.

[31] Proposal PRD 2016, p. 5-6.

[32] Proposal PRD 2016, p. 2.

[33] Proposal PRD 2016, p. 7.

[34] Treaty on the Functioning of the European Union, O.J. C 326/47.

[35] See further E. Ghio, J.M.G.J Boon, D.C. Ehmke, J. Gant, L. Langkjaer & E. Vaccari, ‘Harmonising Insolvency Law in the EU: New Thoughts on Old Ideas in the Wake of the COVID-19 Pandemic’, International Insolvency Review, 2021, 30(3), p. 431 and 435-436.

[36] Recitals 1 and 8 PRD 2019.

[37] Recitals 2 and 15 PRD 2019.

[38] Recitals 2, 3 and 16 and Article 4(1) PRD 2019; Impact Assessment Proposal PRD 2016, p. 13 et seq; R.D. Vriesendorp, ‘How to measure the success of national implementations of the Restructuring Directive?’ in: E. Vaccari and E. Ghio (eds.), Insolvency Law in Times of Crisis, Nottingham: INSOL Europe 2023, p. 96-97.

[39] G.A. Wabl and M. Trenker, ‘The Austrian Implementation of the PRD 2019: Game Changer or Missed Opportunity’, HERO,2022/W-005 (HERO AT), available at www.online-hero.nl/art/4358/special-issue-preventive-restructuring-5-the-austrian-implementation-of-the-prd-2019-game-changer-or-missed-opportunitywww.online-hero.nl/art/4358/special-issue-preventive-restructuring-5-the-austrian-implementation-of-the-prd-2019-game-changer-or-missed-opportunity.

[40] L. Langkjaer, ‘The PRD 2019 in Denmark: There is a First for Everything’, HERO, 2022/W-007 (HERO DK), available at: www.online-hero.nl/art/4453/special-issue-preventive-restructuring-7-the-prd-2019-in-denmark-there-is-a-first-for-everything.

[41] E. Ghio, ‘The French transposition of the EU Directive on Preventive Restructuring 2019: revamping the law while preserving the status quo’, HERO, 2022/W-003 (HERO FA), available at: www.online-hero.nl/art/4346/special-issue-preventive-restructuring-3-the-french-transposition-of-the-eu-directive-on-preventive-restructuring-2019-revamping-the-law-while-preserving-the-status-quo.

[42] S. Madaus and D.C. Ehmke, ‘Germany: Still Waiting for the Revolution in Restructuring to Come?’, HERO, 2022/W-004 (HERO DE), available at: www.online-hero.nl/art/4351/special-issue-preventive-restructuring-4-germany-still-waiting-for-the-revolution-in-restructuring-to-come.

[43] I. Bazinas and A. Paizis, ‘The New Greek Insolvency Law: The Latest Chapter in a Never-Ending Story of Reforms’, HERO,2022/W-006 (HERO EL), available at: www.online-hero.nl/art/4391/special-issue-preventive-restructuring-6-the-new-greek-insolvency-law-the-latest-chapter-in-a-never-ending-story-of-reforms.

[44] J.M.G.J Boon, R.D. Vriesendorp and H. Koster, ‘The WHOA: the Breakthrough for a Dutch Business Rescue Culture’, HERO, 2022/W-008 (HERO NL), available at: www.online-hero.nl/art/4464/special-issue-preventive-restructuring-8-the-whoa-the-breakthrough-for-a-dutch-business-rescue-culture.

[45] E. Vaccari and J.L.L. Gant, ‘The UK Preventive Restructuring Framework after Brexit: Acknowledging EU’s Supremacy?’, HERO, 2022/W-002 (HERO UK), available at: www.online-hero.nl/art/4344/special-issue-preventive-restructuring-2-the-uk-preventive-restructuring-framework-after-brexit-acknowledging-eu-s-supremacy.

[46] Where references are made to implementation, for the UK this must be read as drawing inspiration from the PRD 2019, without being formally required to do so.

[47] Art. 288 TFEU.

[48] Article 4(5) PRD 2019, see also above para 3.2.

[49] Article 4(1) PRD 2019.

[50] Kamerstukken II 2017/18, 33 695, nr. 17, p. 4; Kamerstukken II 2018/19, 35 249, nr. 3 , p. 4; Kamerstukken II 2018/19, 33 695, nr. 18, p. 3. See on this matter also Sits Schreurs, ‘Implementatie van de Herstructureringsrichtlijn: wellicht beter in de surseance dan in de WHOA?’, Tijdschrift voor Insolventierecht, 2019/33, para 1 and 4.

[51] HERO NL, para 3.2 and note 51.

[52] See also D. Skauradszun and G. Tsignopoulou, ‘The Transposition of the Directive on Preventive Restructuring Frameworks into Greek Law’, 10 Nottingham insolvency and business law e-journal, 2022(1), para IV.

[53] Recital 16 PRD 2019.

[54] Article 4(1) PRD 2019. Compare also Article 1(1)(a) PRD 2019.

[55] Recital 24 PRD 2019.

[56] Article 4(1) and (8) PRD 2019.

[71] This may be inferred from the lack of provisions regarding non-applicability to insolvent debtors, and at various points furthering general flexibility with implementing the PRD 2019 is reiterated, including in Recitals 13 and 16, and Articles 2(2)(a) and (b), 4(3) and (5) PRD 2019.

[72] Article 2(2)(a) and (b) PRD 2019.

[73] European Commission Proposal for a Directive of the European Parliament and the Council harmonising certain aspects of insolvency law, 7 December 2022, COM(2022) 702 final, p. 4; European Commission, Commission Staff Working Document, Impact Assessment, Accompanying the document Proposal for a Directive of the Parliament and of the Council harmonising certain aspects of insolvency law, 7 December 2022, SWD(2022) 395 final, p. 8, 13 and 14-15.

[74] European Commission, Commission Staff Working Document, Impact Assessment, Accompanying the document Proposal for a Directive of the Parliament and of the Council harmonising certain aspects of insolvency law, 7 December 2022, SWD(2022) 395 final, p. 89. There was similar opposition on this matter when the PRD 2019 was prepared, see Impact Assessment Proposal PRD 2016, p. 23, 60 and 93.

[75] Recital 30 PRD 2019.

[76] Recital 30 and Article 5(2) and (3) PRD 2019.

[77] Recital 31 and Article 5(3) PRD 2019.

[78] Recital 30 PRD 2019.

[88] HERO FA, para 2.2.

[89] Article 6(1) PRD 2019.

[90] See for a detailed overview of the different policy options J. Garrido, C. DeLong, A. Rasekh and A. Rosha, Restructuring and Insolvency in Europe: Policy Options in the Implementation of the EU Directive, IMF Working Paper, 2021/152, p. 13 et seq.

[91] Article 6(1) and (6) PRD 2019.

[99] Consider for instance Articles 9(4), 11, 12 and 13.

[100] J. Garrido, C. DeLong, A. Rasekh and A. Rosha, Restructuring and Insolvency in Europe: Policy Options in the Implementation of the EU Directive, IMF Working Paper, 2021/152, p. 16.

[101] Article 9(1) PRD 2019.

[102] Article 9(2) AND (3) PRD 2019.

[103] Article 9(6) PRD 2019.

[104] Articles 9(6) and 10 PRD 2019.

[105] Article 11(1)(b) PRD 2019.

[106] See for instance: S. Madaus, ‘Leaving the shadows of US Bankruptcy Law: A Proposal to Divide the Realms of Insolvency and Restructuring Law’, European Business Organization Law Review, 2019, p. 615-647; R.J. de Weijs, A. Jonkers & M. Malakotipour, ‘The Imminent Distortion of European Insolvency Law: How the European Union Erodes the Basic Fabric of Private Law by Allowing 'Relative Priority' (RPR)’, Tijdschrift voor Belgisch Handelsrecht, 2019/125(4); G. Ballerini, ‘The Priorities Dilemma in the EU Restructuring Directive: Absolute or Relative Priority Rule?’, International Insolvency Review, 2020, 30(1), p. 7-33; R.P. Freitag, ‘General Aspects of the Directive on Restructuring and Insolvency’, Zeitschrift für Vergleichende Rechtswissenschaft, 2022, 121, para 2(b).

[107] Article 11(1)(c) PRD 2019.

[108] Article 11(2), first sentence, PRD 2019.

[109] Article 11(2), last sentence, PRD 2019.

[120] HERO EL, para 4.2.1.

[121] Article 1(1) EIR 2015.

[122] Recitals 12-14 PRD 2019. Cross-border insolvency aspects of PRFs also appear in in Article 6(8) PRD 2019 limiting the duration of a stay in case (i) a process does not meet the requirements being subject to the EIR 2015 and (ii) debtors have moved their centre of main interests within three months prior to requesting ‘for the opening of preventive restructuring proceedings’.

[123] Recital 13 PRD 2019.

[124] Recital 13 and Article 1(1) EIR 2015. See on this among others: W.J.E. Nijnens, ‘Internationaal privaatrechtelijke aspecten van de WHOA’, Tijdschrift voor Insolventierecht 2019/34; P.M. Veder, ‘Internationale aspecten van de WHOA: de openbare en de besloten akkoordprocedure buiten faillissement’, Tijdschrift Financiering, Zekerheden en Insolventierechtpraktijk, 2019/6; J.M.G.J. Boon, R.D. Vriesendorp & R. Sijbesma, ‘Netherlands Commercial Court als mogelijke WHOA-rechter bij internationale herstructureringen’, HERO, 2021/W-001, para 3.1; J. Schmidt, ‘Präventiver Restrukturierungsrahmen: Internationale Zuständigkeit, Anerkennung und anwendbares Recht’, Zeitschrift für das gesamte Insolvenzrecht, 2021/654, at 654-656; R.D. Vriesendorp, W. van Kesteren, E. Vilarin-Seivane & S. Hinse, ‘Automatic recognition for the Dutch undisclosed WHOA procedure in the European Union’, NIPR, 2021/1. See also S. Madaus and B. Wessels, CERIL Report 2022-2 on Cross-Border Effects in European Preventive restructuring, 2022 (available at: www.ceril.eu/news/ceril-report-2022-2-on-cross-border-effects-in-european-preventive-restructuring).

[125] Regulation (EU) No 1215/2012 of the European Parliament and of the Council of 12 December 2012 on

jurisdiction and the recognition and enforcement of judgments in civil and commercial matters (recast), O.J. L 351/20.

[134] S. Madaus and B. Wessels, CERIL Report 2022-2 on Cross-Border Effects in European Preventive restructuring, 2022 p. 7 (available at: www.ceril.eu/news/ceril-report-2022-2-on-cross-border-effects-in-european-preventive-restructuring).

[135] Recital 12 PRD 2019.

[136] Article 4(5), second sentence, PRD 2019.

[137] R.P. Freitag, ‘General Aspects of the Directive on Restructuring and Insolvency’, Zeitschrift für Vergleichende Rechtswissenschaft, 2022, 121, p. 229-231 and 243-244.

[138] See Recital 6 Proposal PRD 2016 and Proposal PRD 2016, p. 2 where the Commission only states that ‘[m]any investors mention uncertainty over insolvency rules or the risk of lengthy or complex insolvency procedures in another country as a main reason for not investing or not entering into a business relationship outside their own country.’

[139] Compare H. Eidenmüller, ‘The Rise and Fall of Regulatory Competition in Corporate Insolvency Law in the European Union’, 20 European Business Organization Law Review, 2019, para 6; R.P. Freitag, ‘General Aspects of the Directive on Restructuring and Insolvency’, Zeitschrift für Vergleichende Rechtswissenschaft, 2022, 121, p. 229-231 and 244; R. Dammann and M. Gerrer, ‘The Transposition of the EU Directive on Early Corporate Restructuring and Second Chance into French Law’, Revista General de Insolvencias & Reestructuraciones, 2022(5), p. 401. Although left outside of the scope of this study and having received limited discussion so far, the EU legislator has considered the role of judges and practitioners in Articles 26 and 27 PRD 2019. See on this B. Wessels, ‘EU has High Expectations of Judges in Restructuring Cases’, International Corporate Rescue, 2020, 17, p. 253 et seq. On how this has been implemented in the Netherlands, see: S. Boot, M.C. Bosch, J.C.A.T. Frima en H.J. van Harten, ‘Duidelijk, transparant en rechtvaardig’, Tijdschrift voor Insolventierecht, 2023/1, p. 4 et seq.

[140] Compare also European Bank for Reconstruction and Development, EBRD Insolvency Assessment on Reorganisation Procedures, 2022, p. 4.

[141] HERO UK, paras 1, 3 and 4.

[142] Consider for instance the introduction of non-public processes in the Netherlands and Germany.

[143] Consider for instance the involvement of practitioners in Austria and France, or Greece.

[144] Article 4(5) PRD 2019.

[145] Proposal PRD 2016, p. 7.

[146] Impact Assessment Proposal PRD 2016, p. 51.

[147] D.C. Ehmke, J.L.L. Gant, J.M.G.J. Boon, L. Langkjaer & E. Ghio, ‘The European Union preventive restructuring framework: A hole in one?’, International Insolvency Review, 2019, 28(2), para 4.1 and 5.

[148] C. Thole, ‘Die Umsetzungsgesetzgebung zur Restrukturierungsrichtlinie in Europa – Gemeinsames und Trennendes – Synthese aus den Beiträgen des Heftes 3/2022 der ZVglRWiss’, Zeitschrift für Vergleichende Rechtswissenschaft, 2022, 121, p. 396.

[149] R. Bork and R. Mangano, European Cross-Border Insolvency Law, Second edition, Oxford: Oxford University Press, 2022, p. 38.

[150] J. L.L. Gant, J.M.G.J Boon, D.C. Ehmke, E. Ghio, L. Langkjaer, E. Vaccari and P.J. Omar, ‘The EU preventive restructuring framework: in extra time?’, Fizetésképtelenségi Jog (Insolvency Law), 2022, para 4, available at: https://jogaszvilag.hu/szakma/the-eu-preventive-restructuring-framework-in-extra-time/.

[151] Impact Assessment Proposal PRD 2016, p. 51.

[152] For an overview of the implementation measures reported to the Commission (Article 34(3) PRD 2019), see: https://eur-lex.europa.eu/legal-content/EN/NIM/?uri=celex:32019L1023. Some of these Member States – who have not notified the transposition measures – may have already a preventive restructuring framework in place.

[153] HERO EL, para 5.

[154] HERO NL, para 5.

[155] HERO AT, para 5.

[156] HERO DE, para 5; HERO UK, para 5.1; C. Thole, ‘Die Umsetzungsgesetzgebung zur Restrukturierungsrichtlinie in Europa – Gemeinsames und Trennendes – Synthese aus den Beiträgen des Heftes 3/2022 der ZVglRWiss’, Zeitschrift für Vergleichende Rechtswissenschaft, 2022, 121, p. 391.

[157] HERO UK, para 5.1.

[158] Compare E. Inacio, ‘Record low number of insolvencies, calm before the storm?’, Eurofenix, Autumn, 2020, p. 13-14; Dun & Bradstreet Worldwide Network, Global Bankruptcy Report, 2020, p. 4 et seq; Dun & Bradstreet Worldwide Network, Global Bankruptcy Report, 2021, p. 4 et seq.

[159] See for instance HERO DE, paras 4.9 and 5 ; HERO DK, 4.9; HERO NL, para 5.

[160] See for instance HERO FA, para 5; HERO DK, para 5; HERO UK, para 5.7.

[161] See for instance, HERO AT, para 5; HERO DK, para 5; HERO EL, para 5.

[162] HERO AT, para 5; HERO DE, para 5.

[163] HERO AT, para 5.

[164] HERO AT, para 5, compare also HERO UK, para 5.7.

[165] HERO AT, para 5; HERO DK, para 5.

[166] H. Eidenmüller, ‘The Rise and Fall of Regulatory Competition in Corporate Insolvency Law in the European Union’, 20 European Business Organization Law Review, 2019, para 6.

[167] Vriesendorp has launched a call for a more extensive analysis on implementations of the PRD 2019, see R.D. Vriesendorp, ‘How to measure the success of national implementations of the Restructuring Directive?’ in: E. Vaccari and E. Ghio (eds.), Insolvency Law in Times of Crisis, Nottingham: INSOL Europe 2023, p. 101.

[168] European Commission, Proposal for a Directive of the European Parliament and the Council harmonising certain aspects of insolvency law, 7 December 2022, COM(2022) 702 final.

Keywords

Auteur(s)

Hoogleraar ondernemingsrecht aan de Universiteit Leiden